Table of Contents

ToggleAtal Pension Yojna Scheme and Benefits

The scheme, Atal Pension yojna (APY) was launched by Prime Minister Shri Narendra Modi on 09 May 2015 to provide old age social security to Indian Citizens, with a particular focus on the poor, underprivileged, and workers in the unorganized sectors. This scheme is regulated by the Pension Funds Regulatory Authority of India (PFRDA).

What is Atal Pension Yojna (APY)

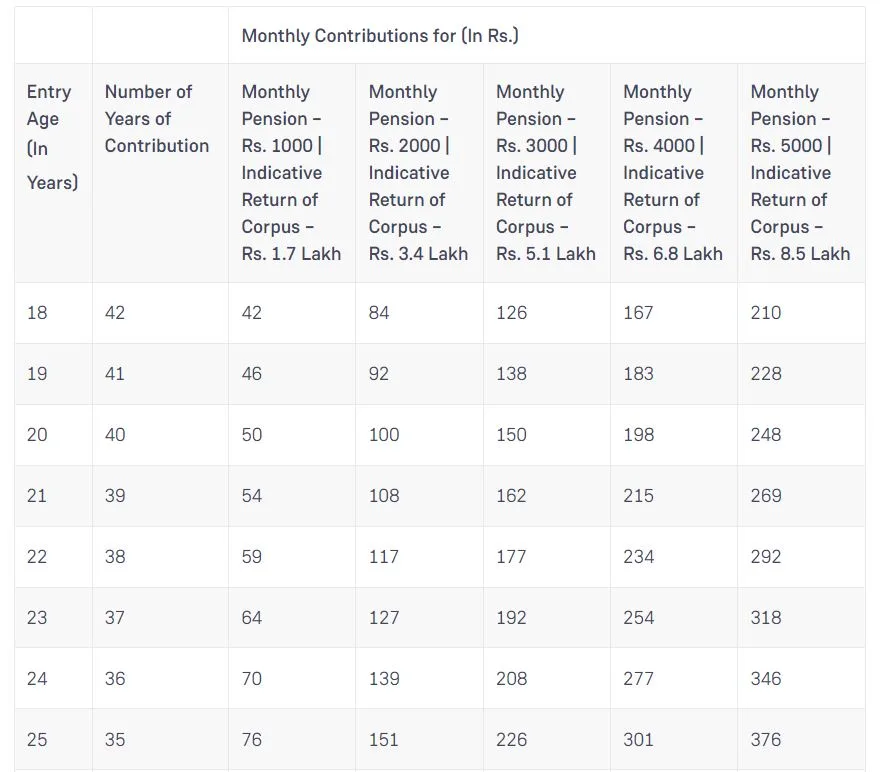

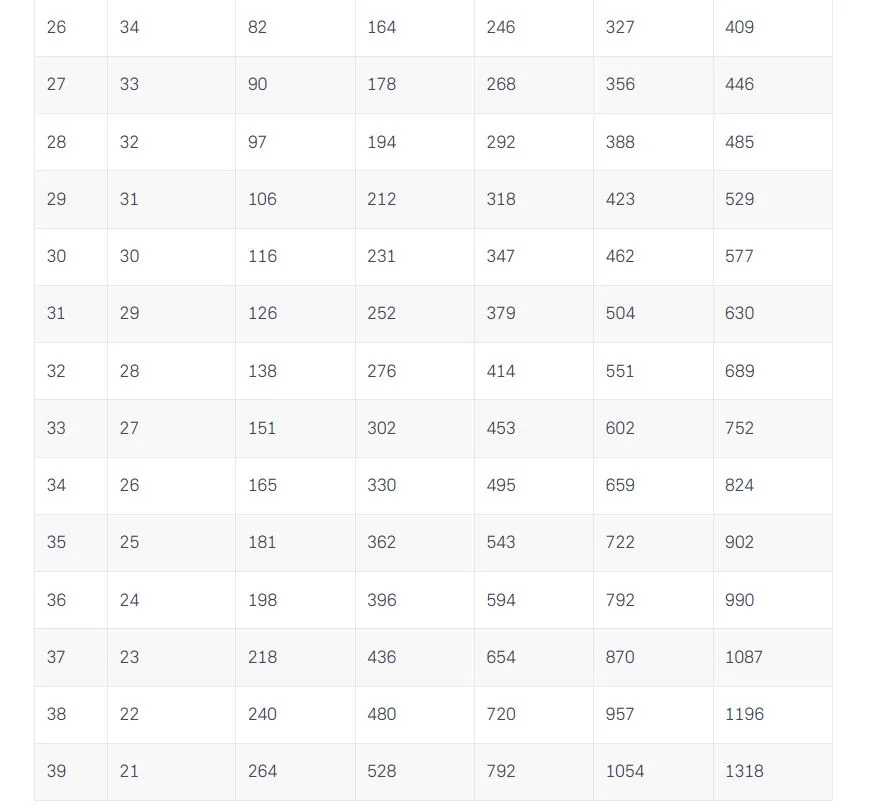

The Scheme, guaranteed minimum pension of Rs. 1,000/- or 2,000/- or 3,000/- or 4,000 or 5,000/- per month will be provided to at the age of 60 years depending on the contributions by the subscribers. Any Citizen of India can join APY scheme. Criteria to join the Scheme Atal Pension Yojna (APY) are as follows:

- The age of the subscriber should be between 18 – 40 years.

- He/ She should have a savings bank account/ post office savings bank account.

Objective of Atal Pension Yojna (APY)

The scheme was targeted to overcome the basic financial obligation which will arise in their retirement phase by encouraging saving at early age. The amount of pension which an individual will receive depends on the contribution made during young age.

Beneficiaries of Atal Pension Yojana (APY) shall receive their accumulated corpus in the form of monthly payments. In the event of a beneficiary’s death, his/her spouse shall continue to receive pension benefits; and in case both such individuals are deceased, the beneficiary’s nominee shall receive the amount in a lump sum.

Atal Pension Yojna (APY) Scheme details and features

Automatic debit

Atal Pension Yojna (APY), enabled with auto debit facility, wherein the subscription amount for the scheme will be auto dabited from subscriber saving account. Subscriber needs to maintain sufficient balance in saving account to avoid any penalty.

Facility to increase contributions

As we discussed earlier, subscriber need to choose their pension amount and accordingly contribution being set after factoring age. If at later stage, individual decided to get higher amount of pension at old age, his / her pension account will be backed up by an increasing contribution. To facilitate this requirement, the government provides an opportunity to increase and even decrease one’s contributions once a year to change the corpus amount.

Guaranteed pension

Beneficiaries of the scheme can choose to receive a monthly pension of Rs. 1000, Rs. 2000, Rs. 3000, Rs. 4000, or Rs. 5000, depending on their monthly contributions.

Withdrawal policies for Atal Pension Yojna

After attaining the age of 18 years and within the bracket of 40 years, he / she can decide to invest in the Atal Pension Yojana. Therefore, college students can also invest in this scheme to create a corpus for their old age. 40 years has been set as the maximum bar for entry into the programme, as contributions to this scheme shall be made for at least 20 years.

Age restrictions of Atal Pension Yojna

Beneficiary is eligible for pension after attaining the age of 60, this amount can be withdrawn in lump sum amount, it depends on the contribution he/ she was made.

One can only exit this scheme before reaching the age of 60 under circumstances like terminal illness or death.

In the case of a beneficiary’s death, before he/she reaches 60 years of age, his/her spouse shall be entitled to receive a pension. As such, the spouse has an option to either exit the scheme with the corpus or continue to receive pension benefits.

However, if individuals choose to exit the scheme before they reach 60 years of age, they shall only be refunded their cumulative contributions and interest earned thereon.

Withdrawal policies for Atal Pension Yojna

The beneficiary is eligible for pension after attaining the age of 60, this amount can be withdrawn in lump sum amounts, depending on the contribution he/ she made.

One can only exit this scheme before reaching the age of 60 under circumstances like terminal illness or death.

In the case of a beneficiary’s death, before he/she reaches 60 years of age, his/her spouse shall be entitled to receive a pension. As such, the spouse can either exit the scheme with the corpus or continue to receive pension benefits.

However, if individuals choose to exit the scheme before they reach 60 years of age, they shall only be refunded their cumulative contributions and interest earned thereon.

Terms of penalty of Atal Pension Yojna

If the subscriber delayed the payment following charges may be applicable

Charges for default

Banks are required to collect additional amount for delayed payments, such amount will vary from

minimum Re 1 per month to Rs 10/- per month as shown below:

- Re. 1 per month for contributions upto Rs. 100 per month.

- Re. 2 per month for contribution upto Rs. 101 to 500/- per month.

- Re 5 per month for contribution between Rs 501/- to 1000/- per month.

- Rs 10 per month for contribution beyond Rs 1001/- per month.

- The fixed amount of interest/penalty will remain as part of the pension corpus of the subscriber.

Important information for subscriber : Atal Pension Yojna

Discontinuation of payments of contribution amount shall lead to the following:

After 6 months account will be frozen.

- After 12 months account will be deactivated.

- After 24 months account will be closed.

- Subscriber should ensure that the Bank account is funded enough for auto debit of contribution amount.

Exit :

On attaining the age of 60 years:

- The exit from APY is permitted at the age of 60 with 100% annuitisation of pension wealth.

- In case of death of the Subscriber due to any cause:

- In case of death of subscriber pension would be available to the spouse and on the death of both of them (subscriber and spouse), the pension corpus would be returned to his nominee.

Exit Before the age of 60 Years:

Exit before 60 years of age is not permitted however it is permitted only in exceptional circumstances, i.e., in the event of the death of beneficiary or terminal disease.

Tax exemptions on Atal Pension Yojna

Tax exemption is available on contributions made by individuals towards Atal Pension Yojana under Section 80CCD of the Income Tax Act, 1961.

All banks are authorised for opening of a pension account under the Atal Pension Yojana.

Click Here for back to Home Page

The Atal Pension Yojana (APY) is a government-backed pension scheme aimed at ensuring a secure financial future for the unorganized sector workforce in India. Launched under the vision of former Prime Minister Atal Bihari Vajpayee, APY encourages workers from the unorganized sector to save for their retirement through a voluntary contribution plan.

Key features and benefits of the Atal Pension Yojana include:

Guaranteed Pension: APY offers a guaranteed minimum pension ranging from Rs. 1,000 to Rs. 5,000 per month, depending on the contribution amount and tenure chosen by the subscriber.

Easy Enrollment: The scheme is open to all Indian citizens aged between 18 to 40 years, making it accessible to a wide range of individuals in the unorganized sector.

Contributory Nature: Subscribers make regular contributions towards their pension fund during their working years, ensuring financial stability during retirement.

Government Co-Contribution: Depending on the contribution amount and the subscriber’s income criteria, the government may also contribute a co-contribution for a specified period to boost savings.

Flexibility: APY offers flexibility in choosing the pension amount and the contribution period, enabling subscribers to plan their retirement according to their financial capabilities.

APY aims to provide social security and financial independence to workers in the unorganized sector who may not have access to formal pension plans. By encouraging long-term savings and prudent financial planning, APY contributes significantly to improving the quality of life for retirees in India.