Table of Contents

TogglePradhan Mantri Mudra Yojana :Loan Limit Raised to ₹20 Lakh from ₹10 Lakh

“Millions of common men and women of this country, who run small business, have almost remained outside the net of formal institutional finance, in spite of their large contribution to the economy. MUDRA is our innovation of funding the unfunded.”

~ Prime Minister Narendra Modi

Pradhan Mantri Mudra Yojana: Empowering Small Businesses and Entrepreneurs

Discover the Pradhan Mantri MUDRA Yojana (PMMY), a transformative initiative by the Government of India, providing collateral-free loans up to ₹20 lakh to empower small and micro enterprises, fostering financial inclusion and entrepreneurial growth across the nation.”

In India, small businesses form the backbone of the economy, contributing significantly to employment and innovation. However, access to finance has been a persistent challenge for many entrepreneurs. To address this gap, the Government of India launched the Pradhan Mantri Mudra Yojana (PMMY) in April 2015, a transformative initiative aimed at providing easy access to credit for micro and small enterprises.

The Pradhan Mantri MUDRA Yojana (PMMY), launched by the Prime Minister on April 8, 2015, has been instrumental in empowering non-corporate, non-farm small and micro enterprises by providing loans of up to ₹10 lakh. To further support aspiring entrepreneurs, the finance minister announced an increase in the loan limit to ₹20 lakh during the Union Budget 2024-25 on July 23, 2024. This new limit came into effect on October 24, 2024.

This announcement also introduces a new loan category, Tarun Plus, specifically designed for those who have previously availed and successfully repaid loans under the Tarun category. This allows them to access funding between ₹10 lakh and ₹20 lakh. Additionally, the Credit Guarantee Fund for Micro Units (CGFMU) will now provide guarantee coverage for these enhanced loans, further reinforcing the government’s commitment to nurturing a robust entrepreneurial ecosystem in India.

The Pradhan Mantri MUDRA Yojana (PMMY), which stands for Micro Units Development & Refinance Agency Ltd, is a financial institution set up by the Government of India under PMMY for the development and refinancing of micro unit enterprises. PMMY aims to provide financial inclusiveness and support to marginalized and socio-economically neglected classes. It has empowered millions, giving wings to their dreams and aspirations, along with a sense of self-worth and independence.

Need for the MUDRA Yojana

India is a young country brimming with enthusiasm and aspirations. To provide a fertile ground for sowing the seeds of India’s development, it is crucial to harness the innovative zeal of young India, which can offer new-age solutions to existing gaps in the economic ecosystem. Recognizing the need to tap into the latent potential of entrepreneurship in India, the Union Government launched the Pradhan Mantri MUDRA Yojana (PMMY).

MUDRA Loans: Categories

Under PMMY, collateral-free loans of up to ₹20 lakh are extended by Member Lending Institutions (MLIs) such as Scheduled Commercial Banks, Regional Rural Banks (RRBs), Small Finance Banks (SFBs), Non-Banking Financial Companies (NBFCs), and Micro Finance Institutions (MFIs). These loans are provided for income-generating activities in the manufacturing, trading, and services sectors, as well as for activities allied to agriculture.

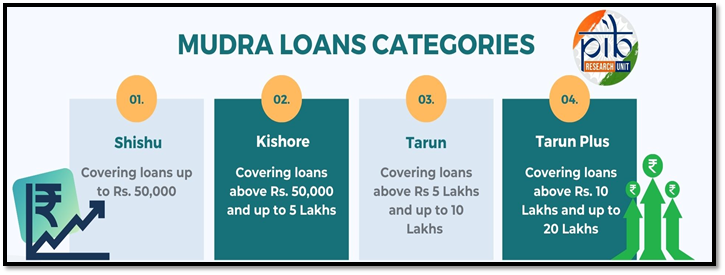

MUDRA loans are now offered in four categories: ‘Shishu’, ‘Kishore’, ‘Tarun’, and the newly added ‘Tarun Plus’. These categories signify the stage of growth or development and the funding needs of the borrowers:

Shishu: covering loans up to ₹50,000

Kishore: covering loans above ₹50,000 and up to ₹5 lakhs

Tarun: covering loans above ₹5 lakhs and up to ₹10 lakhs

Tarun Plus: covering loans from ₹10 lakhs up to ₹20 lakhs

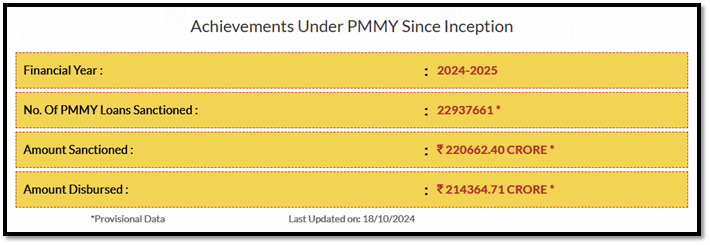

Achievements of Pradhan Mantri Mudra Yojana (PMMY) in 2023-24

Under the Pradhan Mantri Mudra Yojana (PMMY), significant progress was made in the financial year 2023-24. The amount sanctioned and disbursed under various categories is as follows:

Women Borrowers

Shishu category: ₹1,08,472.51 crore disbursed

Kishore category: ₹1,00,370.49 crore disbursed

Tarun category: ₹13,454.27 crore disbursed

Minority Borrowers

Shishu category: ₹15,759.66 crore disbursed

Kishore category: ₹20,766.3 crore disbursed

Tarun category: ₹8,562.27 crore disbursed

New Entrepreneurs / Accounts

Shishu category: 88,49,101 accounts with ₹29,445.41 crore sanctioned and ₹28,839.75 crore disbursed

Kishore category: 34,06,239 accounts with ₹62,290.58 crore sanctioned and ₹60,407.02 crore disbursed

Tarun category: 7,57,456 accounts with ₹70,294.35 crore sanctioned and ₹68,861.13 crore disbursed

Unique Borrowers (from 8th April 2015 to 31st March 2024)

Shishu category: ₹44,891.82 crore sanctioned

Kishore category: ₹24,575.57 crore sanctioned

Tarun category: ₹19,120.58 crore sanctioned

Mudra Card

The MUDRA Card is an innovative credit product that allows borrowers to access credit in a hassle-free and flexible manner. It provides a working capital arrangement in the form of an overdraft facility. As a RuPay debit card, the MUDRA Card can be used to withdraw cash from ATMs or Business Correspondents and make purchases using Point of Sale (POS) machines. Additionally, borrowers can repay the amount whenever surplus cash is available, thereby reducing the interest cost.

MUDRA App – “MUDRA MITRA”

The MUDRA MITRA mobile application, available on both Google Play Store and Apple App Store, provides comprehensive information about the Micro Units Development and Refinance Agency Ltd. (MUDRA) and its various products and schemes. This app guides loan seekers on how to approach a banker to avail a MUDRA loan under PMMY. Additionally, users can access useful loan-related materials, including sample loan application forms, through this app.

Steps Taken to Improve Implementation of the Scheme

Handholding Support: Facilitating the submission of loan applications.

Online Applications: Provision for online applications through the PSBloansin59minutes and Udyamimitra portals.

Publicity Campaigns: Intensive campaigns to increase the visibility of the scheme among stakeholders.

Simplified Application Forms: Simplification of application forms to make the process easier for applicants.

MUDRA Nodal Officers: Nomination of MUDRA Nodal Officers in Public Sector Banks (PSBs) to assist with the scheme.

Periodic Monitoring: Regular monitoring of the performance of PSBs with regard to PMMY.

Interest Subvention: A 2% interest subvention on prompt repayment of Shishu loans extended under PMMY for a period of 12 months to all eligible borrowers.

Announced by the Union Finance Minister on May 14, 2020, under the Aatmanirbhar Bharat Package, the scheme was formulated as a specific response to an unprecedented situation. It aims to alleviate financial stress for borrowers at the ‘bottom of the pyramid’ by reducing their cost of credit.

The Pradhan Mantri MUDRA Yojana (PMMY) offers several benefits that have significantly impacted the entrepreneurial landscape in India:

Financial Inclusion

PMMY has played a crucial role in promoting financial inclusion by providing access to credit for non-corporate, non-farm small and micro enterprises. This has enabled many individuals, especially those from marginalized communities, to start and grow their businesses.

Empowerment of Women and Minorities

The scheme has empowered women and minority communities by providing them with the necessary financial support to pursue their entrepreneurial dreams. This has led to increased economic participation and upliftment of these groups.

Collateral-Free Loans

One of the key features of PMMY is the provision of collateral-free loans. This reduces the financial burden on borrowers and makes it easier for them to access credit without the need for substantial assets.

Diverse Loan Categories

PMMY offers loans under four categories—Shishu, Kishore, Tarun, and the newly added Tarun Plus—catering to different stages of business growth and funding needs. This structured approach ensures that borrowers receive appropriate financial support based on their specific requirements.

Support for Various Sectors

The scheme provides loans for income-generating activities in manufacturing, trading, services, and agriculture-related sectors. This broad coverage helps in the overall development of various industries and contributes to economic growth.

Simplified Application Process

The application process for MUDRA loans has been simplified, making it easier for entrepreneurs to apply and receive funding. Online application portals like PSBloansin59minutes and Udyamimitra further streamline the process.

Interest Subvention

PMMY offers a 2% interest subvention on prompt repayment of Shishu loans for a period of 12 months. This reduces the cost of credit for borrowers and encourages timely repayment.

Handholding Support

The scheme provides handholding support to facilitate the submission of loan applications. This includes guidance and assistance from MUDRA Nodal Officers in Public Sector Banks (PSBs).

Economic Growth and Job Creation

By supporting small and micro enterprises, PMMY contributes to economic growth and job creation. The scheme helps in nurturing entrepreneurship, leading to the establishment of new businesses and the generation of employment opportunities.

Periodic Monitoring

The performance of PSBs with regard to PMMY is periodically monitored to ensure effective implementation and address any challenges that may arise.

Overall, the Pradhan Mantri MUDRA Yojana (PMMY) has been instrumental in fostering a robust entrepreneurial ecosystem in India, driving financial inclusion, and supporting the growth of small and micro enterprises.

The Pradhan Mantri MUDRA Yojana (PMMY) has significantly transformed the entrepreneurial landscape in India, driving substantial progress in financial inclusion. By providing essential funding support, the scheme has enabled numerous new entrepreneurs to bring their business ideas to life. Over the years, it has also empowered women and minority communities, creating opportunities for economic upliftment and fostering a more inclusive growth environment. With the loan limit now expanded to ₹20 lakh, PMMY continues to play a crucial role in nurturing small businesses and propelling the nation toward a more equitable and prosperous future.

One thought on “Pradhan Mantri Mudra Yojana :Loan Limit Raised to ₹20 Lakh from ₹10 Lakh”